A Study on the Corporate ESG Impacts on the Company’s Internal Management Performance and ESG Management Types by Industry

© 2023 KIIE

Abstract

The ESG (Environmental, Social, and Governance) management of companies has become essential in the innovative management field of business as the interest in sustainable growth and value-centric investment increases worldwide. Using Refinitiv ESG data, this paper identifies ESG activities that significantly impact corporate performance and analyzes their effects on customers, shareholders, and employee performance by ESG factors. Furthermore, this paper analyzes the current status of ESG management by industry through K-means clustering to provide implications to policymakers and companies for future indicators and ESG practice development. Thus, this paper identified the major variables from the Refinitiv ESG evaluation framework through exploratory factor analysis, conducts confirmatory factor analysis to confirm the model’s fitness, and analyzes the effects of a company’s ESG management activities on performance using structural equation modeling. Through this study, this paper examines that a company’s ESG activities have a positive impact on customer loyalty; however, efforts to improve the environment can have a negative impact on employee satisfaction. Similarly, efforts to improve the environment and governance can have a negative impact on shareholder satisfaction. This implies that there is a need to alleviate the burden derived from environmental and governmental practices and enhance awareness of ESG practices’ necessity to those stakeholders. Additionally, in industry-specific analysis, the manufacturing and infrastructure industries were found to have relatively superior ESG performance, while the absence of physical assets in the banking and some service industries could lead to low ESG performance. As awareness of the global climate crisis and social recognition of sustainable management continues to grow, ESG management and evaluation are expected to become more critical. Therefore, considering the industrial characteristics of companies, it is expected that different ESG evaluation and support methods will be necessary.

Keywords:

ESG Management, Industrial Classification, Internal Management Performance1. Introduction

ESG is an emerging business concept that influences overall corporate management. As the global interest in the company’s sustainable growth has increased, the current interest in the ESG correspond to the global trend such as Sustainable Development Goals (SDGs), denoted by United Nations aiming to achieve seventeen sustainable goal upto 2030 (Litivinenko et al., 2022). However, this sort of business effort on ESG is not a discrete movement but continuous from the company’s efforts, including Corporate Social Responsibility (CSR). However, ESG is distinctive compared to CSR since CSR is a business activity primarily focusing on contributing to society from the perspective of virtue and marketing; ESG is the business indicator to facilitate the investors’ sustainable profit generation (Kim and Li, 2021). Furthermore, expanding from the social contribution, ESG combines the Environment, Social, and Governance factors into a significant standard that corporate should enhance.

Due to the severe climate change and the rise of public concerns about corporate ethics, ESG has become imperative for companies in various industrial fields. Corresponding to the public’s increasing interest in ESG, companies should consider ESG factors in their overall business activities not only limited to production and manufacturing but also in objective setting, strategy establishment, decision-making process, accounting, marketing, investing, and so on. This implementation of the ESG initiative influences the company’s financial valuation primarily since ESG includes the transparent reporting of its ESG achievement and provides significant information related to companies sustainable growth to its investors. However, it is also expected to influence the company’s profitability by indicating its contribution to the community and promoting the value of the product or service on the environmental aspect, which can be attractive to environmentally friendly consumers. Thus, Ondoro (2015) proposes the possibility that the ESG framework can replace the balance scored card, which is a dominant method to evaluate the organization’s performance. However, though there are various studies about the relationship between a company’s ESG to its financial valuation, decisions, stock price, and customer satisfaction, the studies on ESG’s impact on the company’s internal performance such as stakeholders’ satisfaction are limited. Numerous previous studies on ESG management effectiveness have been conducted proactively in accounting or financial fields due to the adhesive relationship between the ESG evaluation framework and companies’ financial valuation (Mardini, 2022). Though there are several studies to examine the impact of ESG management on internal management performance, those studies focus on the partial impact on each stakeholder such as the client or each environment, social, and governance level components (Nilsson et al., 2014; Tarmuji et al., 2016). Furthermore, since there are various distinctive ESG frameworks and measurement methods, Berg et al. (2022) indicate the aggregate confusion derived from the divergence of ESG rating. Also, though the impact of ESG on industries has been studied, and Garcia et al. (2017) verify that sensitive industries can have superior ESG performance than others, still the study on the different features of industries on ESG performance is limited.

Thus, this paper aims to verify the integrative impact of ESG on companies’ internal performance focusing on the variables related to the loyalty of the three major stakeholders including clients, stakeholders, and employees since those three stakeholders have a significant impact on the companies’ performance by influencing on business decision-making process directly or indirectly (Armstrong, 2020). This paper also expects to identify the impact of the ESG evaluation framework on stakeholders’ satisfaction on sub-variable levels contributing to each part of ESG factors. Therefore, through the clustering analysis, this paper defines the types of ESG performance of the companies and analyze the difference by the industry to provide information about where the company focuses on among various ESG components by industries. Through this analysis, this paper expects to supplement the limitations of previous studies which focus on financial performance but are limited in measuring internal management performance such as stakeholders’ satisfaction. Therefore, by analyzing companies’ internal ESG performance of various industries under the Refinitiv ESG framework, this paper has implications for proposing political insights on the current ESG evaluation framework considering companies’ industrial attributes. Thus, the research questions of this paper can be summarized as below:

- RQ1) Examine the impact of ESG management on the company’s internal performance

- RQ2) Identify which ESG factors are significant to the company’s internal performance

- RQ3) Identify the distinctive industrial attributes on ESG performance by industries

2. Literature Review

2.1 ESG Framework

Fundamentally, ESG is generated as an investment principle. However, ESG investing focuses on non-financial dimensions of the business related to the environment, social, and government fields (Duuren et al., 2016). Compared to the traditional investment principle, which invests in financial profitability, ESG is considered a value-driven investment method that appeals company’s sustainable structure and relations. Beyond the range of the investment, ESG expands to the overall management practice of the company as a part of the global green innovation trend corresponding to the increasing ethical consciousness of the public and the global climate crisis. Thus, the current ESG principle is integrative since it covers not only management areas such as resources, products, energy, and other management part but also can be an attractive marketing tool and even have to be applied to accounting. However, as Li et al. (2021) indicated, it is obscure to confine the components of ESG since ESG is developing concepts proposed in 2004 in the United Nations report (2004) under the financial sector initiative to encourage sustainable investment. For instance, generally, ESG is used to measure corporate value from the sustainability perspective; however, this concept can also be applied to measure the nation’s performance. In the case of the World Bank, it categorizes the ESG components at the national level in <Table 1>.

Also, to compare the ESG performance on the firm level, compared to the World Bank’s macro-approach at the national level, Refinitiv and S&P, which score companies’ ESG performance, utilize standards that focus more on the company side. However, unlike Refinitiv, S&P has different components in its ESG evaluation system, as shown in <Table 2>. Likewise, due to the importance of ESG ad sustainable development of the business, various institutions and governments establish various ESG evaluation frameworks. However, as LI et al. (2021) indicated, those various frameworks and standards can intensify the companies’ confusion and stress.

Thus, to verify the effectiveness of ESG framework and management, its validness has been studied frequently, and various indicators such as financial profitability, stock valuation, risk, and so on have been examined as performance indicators with various variables (AYDOGMUS et al., 2022; Budsaratragoon and Jitmaneeroj, 2021). However, considering the effort of the company to enhance its ESG management for enhancing its valuation to attract investors, it is evident that ESG substantially influences internal stakeholders such as employees, shareholders, and customers (Zumente and Bistrova, 2021; Liang and Renneboog, 2020). Likewise, though the ESG influences various stakeholders as in <Figure 1>, the study on the impact of ESG components on the major stakeholders’ loyalty is limited (Tarmuji et al., 2016). Thus, this paper aims to analyze the impact of the company’s ESG performance on the major stakeholders’ loyalty.

2.2 ESG as an Innovation Management

ESG obligations require the company to improve its business in multiple aspects. However, the effectiveness of the ESG on the innovative management aspect has been suspicious since there are concerns, such as whether ESG can demotivate the employees by imposing a regulatory burden and deteriorate customer satisfaction by affecting the quality of its product and service. Based on the doubt about the validity of ESG, Tan and Zhu (2022) examines the impact of ESG as innovative management and verify that it can improve the quality and quantity of green innovation by increasing the consciousness of managers. Furthermore, Tan and Zhu (2022) indicate the effect of ESG, which is more effective for companies under high environmental regulation and market competition during their growth stage. Though Tan and Zhu define the quantity of green innovation as the number of green patents and measure its quality through citation with ESG ranking and governance variables mainly such as board (2022), based on the study, the components of ESG vary. The study of Simone et al. (2022) verifies the relationship between ESG factors and economic sustainability from the innovation perspective. This study utilizes the variable combining the company’s research and development (R&D) intensity and expected growth opportunity. Alareeni and Hamdan (2020) use the data of ESG Bloomberg, which include information about whether the company publicizes the environment, social, and government status transparently. The sub-variable of major ESG components consists of the company’s energy usage, resource treatment, pollution, business relationship, employee health, and others. Alareeni and Hamdan use the financial performance of the company, such as the return on asset (ROA) and equity (ROE), and attest that the company with higher asset and financial leverage tends to be more proactive in ESG management and ESG has positive influences on overall companies’ operation, financial, and market performance.

Compared to the studies which analyze the impact of ESG on the company’s financial performance, the study of Tarmuji et al. (2016) conducted a study about the ESG impact on economic performance using the stakeholders’ loyalty as a dependent variable, focusing on the case of Malaysia and Singapore. In this study, though the environmental variables positively influenced both Singapore and Malaysia companies, however, Singapore companies have more positive relations with social components, and the Malaysian companies are revealed to have more impact from governance components (2016). Similar to Tarmuji et al. (2016) study, this paper also utilizes the data from Refinitiv, named the ASSET 4 dataset, since it has comprehensive data about the ESG variables and the loyalty of the major stakeholders which directly related to the businesses. Based on the assumption that employees, shareholders, and customers are mostly influenced by a company’s ESG management (Zumente and Bistrova, 2021), in addition to Tarmuji et al. (2016) study, this paper aims to examine the relationship between sub-factors constructing ESG components and economic performance focusing on loyalty variables.

Under the organizational behavioral context, CSR is highlighted not only for the virtuous activity of the company but also as a method to enhance stakeholders’ loyalty. Stojanovic et al. examine that a company’s CSR can stimulate employees’ commitment and engagement with the organization. Furthermore, on the shareholder aspect, the study of Byun and Oh (2017) denotes that shareholders value CSR activities when they are properly aware CSR activities of the company. Also, consumers’ satisfaction can be improved by increased involvement from their perception of commitment to the valuable activity (Ahn et al., 2021). Considering ESG as the expansion of CSR (MacNeil and Esser, 2022), ESG can engage the stakeholders not as passive users but as common value-creating partners under the utility theory (Jarvis et al., 2017). From the perspective of contribution to the community, ESG is a more comprehensive concept compared to CSR since it contains the corporation’s valuation. Due to this feature, ESG practices can influence stakeholder values on the aspect of corporate internal management performance (Signori et al., 2021). However, though numerous ESG advocators emphasize the role of the stakeholders in ESG management, it is not apparently defined how respective factors of ESG influence stakeholders (Cornall & Shapiro, 2021). Thus, this paper establishes hypotheses based on previous studies to examine the relationship between ESG factors and major stakeholders who can critically influence ESG management including customers, employees, and shareholders in the following sessions.

Despite the importance of ESG, there are concerns that ESG can impose additional task burdens on employees (Piao et al., 2022). Piao et al. (2022) analyze the relationship between ESG and employee satisfaction focusing on Japanese companies and examine that there are positive impacts through several environmental (EN) practices such as efficient resource reduction processes contributing to employees’ psychological well-being. However, regulatory practices such as pollution management or governance (GO) factors which probably require more work burden for transparent information publication and a high level of moral compliance result in deteriorating employees satisfaction and cause stress (Piao et al., 2022). Instead, the social (SO) factor which can improve the working environment and consider employees‘ health and safety sincerely is verified as having a favorable impact on employee satisfaction (EL). Thus, based on Piao‘s study, this paper has the following hypotheses:

- H1: Company’s EN negatively influences EL

- H2: Company’s SO positively influences EL

- H3: Company’s GO negatively influences EL

Not only the interest in the company’s valuation but, whether the company serves their shareholder fairly can determine the shareholder’s loyalty which implies a sustainable and stable relationship with investors. Furthermore, from the perspective of value creation, ESG performance can provide the information and assurance that the company consider its stakeholder relationships valuable and can sustain its business by mitigating the risk of business failure from moral vulnerability (Dahlberg and Wiklund, 2018). Therefore, based on the assumption that ESG can generate long-term sustainable value which can satisfy the shareholders (SL), the hypotheses are as follow:

- H4: Company’s EN positively influences SL

- H5: Company’s SO positively influences SL

- H6: Company’s GO positively influences SL

Not only for the shareholders, as the customers’ consciousness of ESG has increased, value-centric consumption rise as one of the consumption behavior. Thus, beyond the CSR company’s concern for the environment, fairness, and overall ethical practices can intensify the customers’ loyalty by enhancing the client’s credibility over the company. Ismail et al. (2019) study also denotes that ESG can improve customer loyalty by enhancing public image and reputation. Therefore, this paper assumes that ESG factors have a positive influence on client loyalty (CL) as the following hypothesis:

- H7: Company’s EN positively influences CL

- H8: Company’s SO positively influences CL

- H9: Company’s GO positively influences CL

3. Methodology

3.1 Data Description

This paper utilizes the data provided by Refinitiv. Refinitiv is a company that manages and services financial market data. Refinitiv collects the companies’ ESG data from more than 76 countries. ESG data is collected comprehensively by referring to corporates’ annual reports, websites, NGO websites, stock market information, CSR reports, and media sources.

From this database, this paper uses data with 130983 observations collected from the 2002 to 2021 fiscal year and evaluates the ESG performance of the 12156 companies through their released reports under ten major standards with 719 variables. The variables in this dataset are considered sufficiently consistent and reliable by having Cronbach’s Alpha value as 0.67, 0.77, 0.87, 0.85, 0.71, 0.60, 0.61, 0.68, 0.87, 0.61, 0.68, 0.87, 0.83, 0.79, 0.90, 0.89, 0.91, 0.75, and 0.90 for each ER, PI, RR, BD, IN, SH, Cu, So, Wo, EL, SL, CL, ENV, SOC, GOV, and EC. As <Table 3>, this dataset consists of three levels. The first level (L1) consists of ESG factors and performance variables, and the second level (L2) categorizes variables based on which stakeholders will effect. The third level (L3) variables consist of business practices for ESG management.

The Environment (ENV) has Emission Reduction (ER), Production Innovation (PI), and Resource Reduction (RR). Social (SOC) is constructed with two levels, it has Product Responsibility (PR) for the Customer (CU) dimension, Community (CO), and Human Rights (HR) for the second level (L2) Social (SO) dimension, and Diversity & Opportunity (DO), Employment Quality (EQ), Health and Safety (HS), Training & Development (TD) under Employee (EE) dimension. Corporate Governance (GOV) has Board Function (BF), Board Structure (BS), and Compensation Policy (CP) under the Board dimension. CG also has two other dimensions in the second level: Integration (IN) and Shareholders (SH), which have Vision & Strategy (VS) and Shareholders’ Rights (SR) as sub-variables for each. For the Economic (EC) variable, it has Margins (MA), Profitability (PR), and Revenue (RE). PR includes shareholder loyalty (SL), and RE includes client loyalty (CL). Thus, MA consists of ESG management commitment and effectiveness on employees.

Though the exogenous variable such as country and industry is attested as having an influence on companies’ ESG performance (Shinghania and Saini, 2023; Kumar et al., 2016), since this paper aims to verify the influence of ESG on major stakeholders, it uses company’s industrial information on the clustering analysis to define industrial differences in ESG performance features.

3.2 Research Model

To examine the impact of ESG components on the Economic factor among the various variables, it is required to select significant and distinctive variables. Thus, as in <Table 4>, this paper conducts the data preparation process, Explanatory (EFA), and Confirmatory factor analysis (CFA) prior to forming the Structural Equation Model (SEM) to analyze the causal relationship between ESG and the internal economic performance of the company. Internal economic performance is defined as variables related to employees, customers, and shareholders’ values.

3.3 Exploratory Factor Analysis (EFA)

This paper conducts the Exploratory Factor Analysis (EFA) to select the significant variable among various variables. Prior to the Confirmatory Factor Analysis for measuring the consistency of the structure and factors, EFA based on the Maximum Likelihood (ML) method denotes the proper number of factors. However, before conducting EFA, this paper conducts Kaiser-Meyer Olkin (KMO) model to measure sampling adequacy through the variance proportion in the items, measuring commonality (1). As Li et al. (2020) indicated, KMO should be over 0.5 to be acceptable. Furthermore, on the EFA, the fitness of the model can be verified through the Tucker & Lewis Index (TLI) (2) and Root Mean Square Error of Approximation (RMSEA) which is acceptable when it is over 0.9 and less than 0.08 per each (Xia and Yang, 2019) (3).

| (1) |

| (2) |

| (3) |

3.4 Confirmatory Factor Analysis (CFA)

After deciding the number of the factor and selecting the variables which can fit into the model, this paper conducts the Confirmatory Factor Analysis (CFA) to verify the fitness of the measurement variable corresponding to the structured model. Through the CFA, this paper can attest the whether the measurement model fits the data. Furthermore, since CFA indicates the comprehensive relationships between the variable and factors, through CFA, it is available to identify the potential inconsistencies of the model. Also, by examining the individual factor loadings prior to the SEM, CFA can identify specific variables which contribute more to the factors (Woods & Edwards, 2011). On the CFA, to measure the goodness of the fitness, in addition to the TLI and RMSEA, Chi-square (4), Standardized Root Mean square Residual (SRMR) (5), Goodness of Fit Index (GFI) (6), and Adjusted GFI (AGFI) (7) would be analyzed with Chi-square test (Schermelleh-Engel et al., 2003). Fundamentally, the Chi-square test identifies the difference between observed and expected covariance, which implies that the lower value has a better fit (Alavi et al., 2020). SRMR denotes the discrepancy between the sample covariance and the model covariance. SRMR less than 0.08 is perceived as acceptable (Vellone et al., 2014). AGFI is the corrected indicator of GFI, reflecting the number of indicators per latent variable. GFI is the fit between observed variance and the hypothesized model, and GFI over 0.9 is considered acceptable (Huang et al., 2019). Similar to GFI, Comparative Fit Index (CFI) (8) compares the hypothesized model with a null model where none of the variables are related to one another (Alavi et al., 2020).

| (4) |

| (5) |

| (6) |

| (7) |

| (8) |

3.5 Structural Equation Modeling (SEM)

To examine the causal relationships between multiple variables, SEM can be applied since it is a multivariate technique that combines regression and factor analysis. Through SEM, latent variables can be measured through observed variables, and their relationships can be modeled using structured equations. Similar to CFA, the fitness of SEM estimated through ML can be evaluated through Chi-square, RMSEA, TLI, SRMR, GFI, and AGFI. Though the SEM is a comprehensive statistical model available for measuring direct and indirect impact with factor analysis, linear regression, path, mediation, and other analysis (Kline, 2011), this paper only aims to measure the direct relationship between stakeholders’ performance value with ESG factors.

3.6 K-mean Clustering

After model construction through SEM, this paper utilizes K-mean Clustering to categorize the ESG performance by industry. Through the clustering method which is one of the machine learning methods based on unsupervised learning, this paper expects to define an industry that has similar ESG status and detailed ESG features. For clustering, kmeans function in R, stats packages are used based on the Euclidean distance. Based on the algorithm, the position of the K-mean centers becomes optimized as the following equation (Sinaga and Yang, 2020).

| (9) |

4. Result

4.1 Factor Analysis

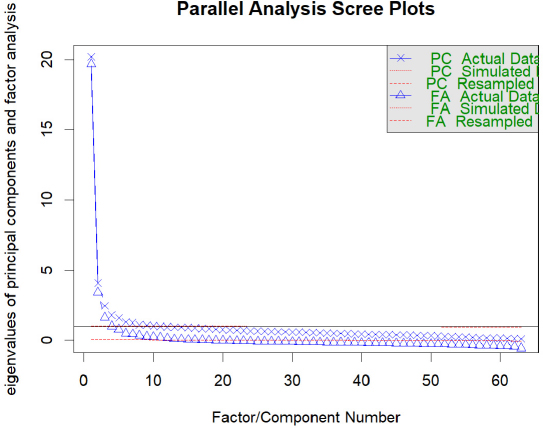

Refer to <Figure 2>, since the eigenvalue of the EFA scree plot converges on factor around 12, this paper utilizes CU, PI, IN, ER, SH, So, Wo, RR, and BD as independent factors and EL, SL, and CL as dependent factors referring to the conceptual framework provided by Refinitiv as <Table 3>. However, though EFA analysis denotes similar factors with the Refinitiv framework by having its L2 factors, for ENV, L3 factors have statistically heterogeneous to the others by satisfying the 0.4 cutoff standard on its loading in Appendix 1 (Wu et al., 2014). This EFA analysis also implies that it is not necessary to utilize detailed standards but factors on L2 can represent the sub-variables sufficiently.

Its overall KMO is over 0.977, which is over 0.5, and implies having a proper correlation matrix. EFA has RMSEA and SRMR as <Table 5>, which satisfies the cutoffs. Therefore, replacing the GFI and other indexes in CFA, this paper analyzes fit, which is fair as much as it is close to 1 and complexity level with a degree of freedom (df) in EFA. The study of Pettersson and Turkheimer (2010) describes Hofmann’s complexity index as when it is 1, it indicates the perfect simple structure, and when it is over 1, it means evenly distributed items that are sufficient to further analysis.

Also, as in <Table 6>, GFI in CFA also satisfies its cutoffs. Through CFA, denoted in Appendix 2, under the ER factor, the variables related to emission, and waste reduction have significant impacts. Also, companies’ efforts to reduce the impact on biodiversity and construct proper environmental management systems are also considerable variables. In the case of PI, companies’ policies for eco-friendly designed products, eco-labeling, life-cycle assessments, and product innovation also denote a high relationship with their investment and consideration of product sustainability and de-materialization. For RR, the variables related to resource efficiencies, such as water, energy, packaging, and others are considered important variables, however, imposing a resource efficiency policy to the supply chain has fair significance to the model. Under the governance factor, BD has auditing, compensation, and nomination as sub-variables with improvement tools. Though there are various variables in IN factor, including compensation, committee, global compact, and others, only integrated strategy policy and CSR-related variables are having a significant impact. Under the SH factor, compared to the other variables such as voting procedures, controversies, and else, their voting rights, sense of engagement, and transparency indicate more impacts. For the social factors, from the Cu perspective, product access and lower price are denoted as important variables, and others that indicate the responsibility for the product such as consideration of quality, customer safety, responsible marketing, and fair trade are followed. Policies and commitment on community involvement, ethics, rights, suppliers, and economy construct So factor. Furthermore, culture and trust between employees, trade unions, training, and health & safety concerns construct the Wo factor. In the case of EC, EL, and CL have employee and client satisfaction as measuring variables, however, the SL factor has insider trading, and transparency as significant variables which impact their loyalty level. Thus, based on the CFA model, the causal relationship can be examined through SEM.

4.2 SEM Analysis

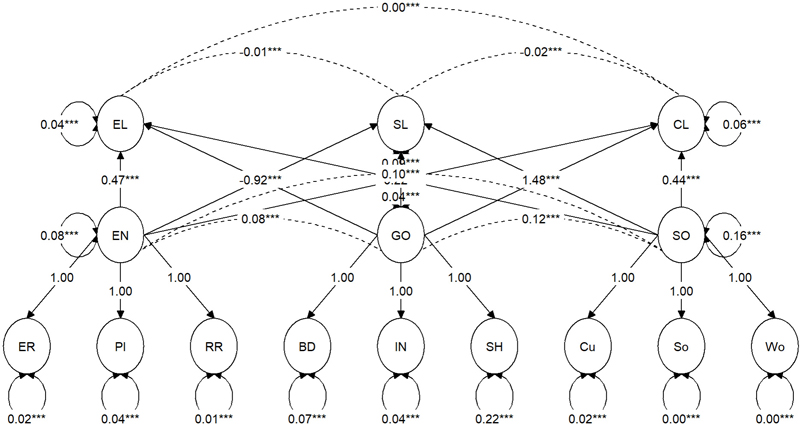

The hypothesized SEM model used in this paper can be denoted as <Figure 3> and <Table 7>.

Since the p-values of the hypotheses are less than the confidence level of 95%, all the hypotheses are significant. However, H1, H7, and H9 are rejected since though the environmental factor has a positive influence on the EL (H1) and CL (H4), it can deteriorate the SL (H7). Though previous studies verify that the burden to satisfy environmental standards required in ESG practice can have a negative impact on EL (Piao et al., 2022), similar to McKinsey’s analysis which postulates the superior ESG proposition can enhance employees’ motivation by stimulating the sense of purpose (Henisz et al., 2019) the sense of contributing to the community derived from environmental practice in ESG initiative seems like improving employee motivation in this study. Furthermore, compared to the initial hypotheses that EN and GO have a positive impact on SL by increasing companies’ value and organizing systems for the shareholders, the SEM analysis indicates a negative relationship (Dahlberg & Wiklund, 2018). These results can be assumed by a similar context with H3. In Menner and Menningers’ study (2018), the negative causal relationship between governance and employee and shareholder satisfaction since intensified governance can strengthen managers’ interest in short-term performance but decrease interest in long-term investments such as human resources. Likewise, the burden to sustain transparency, fairness of the voting process, and other governance factors can cause a burden to the employees and shareholders. Moreover, this sort of burden leads to negligence of shareholder management the can deteriorate shareholder value in the long-term aspect. However, as it initially assumed in the previous study, SEM analysis denotes the positive impact of ESG on ESG to CL through satisfying customers’ needs for ethical consumption (Ismail et al., 2019).

4.3 K-mean clustering

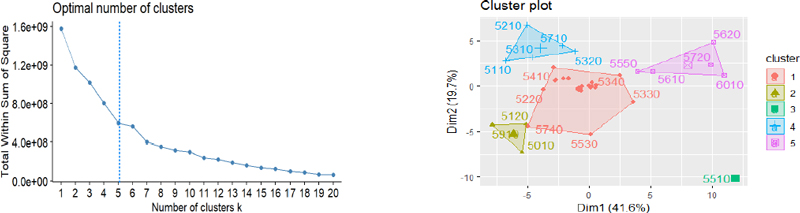

Based on the SEM, using the elbow method on the K-mean clustering, which set the proper cluster number where the point considerably decreases through the scree plot as it is on the left side of <Figure 4>. Thus, this paper set 5 as the cluster number and has cluster as on the right side of <Figure 4>.

Referring to the clustering analysis, the fundamental industries related to advanced resources, materials, parts, and equipment are categorized into cluster 1. However, it also includes infrastructural services such as transportation, retailing, etc. Cluster 2 comprises traditional resources such as fossil fuels, minerals, and general utilities. As the bank classifies into cluster 3 independently, it indicates distinctive ESG features compared to the others. Cluster 4 can be considered as formed with the manufacturing industry, and Cluster 5 seems like specified to the customer-oriented services (<Table 8>).

As in <Table 9>, cluster 2 and 4 seems to have superior performance in overall ESG factors. This can be assumed since, due to the emission and environmental impact caused during production, manufacturing, and resource industries sincerely consider the ESG factors more than other industries. Also, cluster 1, which has adhesive relation with public and market infrastructure, indicates fair ESG performance except for the environmental field. However, it seems obvious that such industries as logistics, retail, academic services, and others are hard to improve emission reduction and product innovation significantly. This situation is also reflected in clusters 3 and 5, banking and advanced service sectors. Those industrial sectors consider the shareholders and fair governance structure significantly; however, since those industries have limited visible production, it is hard to satisfy environmental factors. However, despite the industrial specification, refer to tables 9 and 10, they denote inferior social consideration compared to the other clusters, and it seems like it resulted in low satisfaction of stakeholders.

To elaborate on the result, cluster 4 focusing on manufacturing-related industries such as chemicals, goods, and so on, denotes superior performance on EN having a higher value of 17.55 compared to the other clusters. As in <Table 3>, this cluster has tangible products which should conform to emission, product life cycle, and other various standards during their regular operation. Similar to EN, as SO is also adhesively related to its supply chain relationship and production impact on society, those clusters including banking and service denote inferior performance under the current framework. Compared to the EN and SO, GO has improved performance within clusters 3 and 5, however, compared to the other clusters, it also denotes a relatively low performance in GO. Likewise, those industries which do not perform practical production can be faced with comparative disadvantages when applying universe standards. Thus, in the context of practical equity, the further ESG framework and policies should consider different industrial attributes of the corporation.

5. Discussion

Based on the result, this paper examines that those sub-variables such as CU, PI, IN, ER, SH, Do, Wo, RR, and BD can be differentiated statistically under the ESG framework under the current Refinitiv framework data. Therefore compared to the other hypotheses, hypotheses 3, 7, and 9 denote that governance and environmental factors can have a negative impact on employees and shareholder loyalty by imposing corporate burden (Piao et al., 2022; Lu, 2016). Thus, to enhance the internal performance and minimize the dissatisfaction of those stakeholders, several standards, which have a high correlation or are statistically less significant as it in <Table 3>, can be eliminated. Also, regarding the stakeholders’ burden, rather than establishing excessive ESG frameworks from various institutions, the policymakers’ role to provide consistent standards to prevent corporates’ confusion would be required.

Therefore, as the current ESG framework focuses on the production operation considerably through ER, PI, RR, PR, and others, several industries which do not perform production can have disadvantages in performance measurement and comparison. However, corporations that are not directly involved in the production process like banking or service industries also can implement ESG management in their general business operation like saving energy or others even if they do not have tangible products. Thus, the difference in performance status by industries in cluster analysis implies the need for a differentiated framework in ESG management considering their industrial features. Thus, the further ESG framework can be consistent within the industrial group but elaborately differentiated by inter-group base on the industry.

Furthermore, compared to the importance of ESG on the sustainable development aspect, SEM denotes the negative impact on the stakeholders’ satisfaction. Based on the previous study which indicates the difference in internal performance by nations, which have different business environments, ESG performance can be influenced by the macro environment such as policy, culture, and others. Thus, to construct a sustainable business developmental ecosystem, governments and companies can promote ESG management by expanding their communication and education with the stakeholders so that they can perceive the importance of ESG management and their self-esteem from contributing to society.

6. Conclusion

Based on the Refinitiv data, though there are several variables that are not statistically significant, ESG factors constructed with significant variables have a valid impact on performance defined through stakeholders’ value generally. However, this does not imply that all those components have a positive influence on the performance since the EN factor can impede the SL and GO factor also hamper both SL and EL. This can be assumed as though EN and SO factors improve EL by enhancing their morale derived from meaningful activities and perceived contribution. However, GO, which requires high transparency and reasonable decision-making under thorough processes from proactive communication, may impose burdens on the employees within the management process. Also, different from employees, shareholders are more sensitive to the company’s values and hard to engage them in ESG as much as employees. Even if the social activity of the company improves the company’s value by enhancing companies fame, it is hard to be recognized by the shareholders, and they may perceive the obligation to satisfy environmental and governance standards deteriorate the company’s profitability and value.

Thus, for the company side to lead ESG performance to the improvement of the stakeholders’ values, the company should pursue a way to reduce employees’ burden on satisfying governance standards and construct proper support for the shareholders so that they can perceive the company’s ESG activities contribute on its value. Also, to enhance the SL corresponding to the ESG practice, the company should lead agreement from shareholders that though ESG may not improve companies financial value rapidly and drastically, it can contribute to sustaining the business and generating long-term profit. Therefore, since the expansion of interests in ESG is considered irrevocably and non-pausable under the current climate change, economic uncertainty, and others, the mutual consensus over the necessity of ESG among stakeholders and companies can enhance ESG performance.

Also, as denoted in the cluster analysis, compared to the industries related to manufacturing, resources, and infrastructure have superior ESG and economic performances, the service and banking industries indicate relatively inferior performance. Specifically, those clusters seems like having issues with satisfying environmental factor due to the lack of physical product, applying different ESG evaluation methods for the service and financial industry which handle intangible assets can provide more equitable standards.

Though this paper has implications for selecting significant variables which impact on stakeholders’ variables the most and examining their impact on the ESG factors and sub-variables levels. However, compared to the CL and EL which include the satisfaction of the stakeholders in its factor, due to the limitation of the secondary data, this paper has limitations on examining direct satisfaction of the shareholders since it is constructed with the companies shareholder management competence more. Also, though ESG is designed to evaluate the financial performance of companies since it begins from the financial initiative of the United Nations, this paper is focused on the company’s internal performance, especially for the major stakeholders. Thus, in further study, the impact of ESG on a company’s financial performance and value is required with the consideration of the company’s industrial, size, national, and other attributes. Also, ESG is not only an issue of the companies, but an issue of a global society, the macro-level ESG environment on the country-side can provide valuable implications for future study.

References

-

Ahn, J., Shamim, A., and Park, J. (2021), Impacts of cruise industry corporate social responsibility reputation on customers’ loyalty, International Journal of Hospitality Management, 92, 102706. 1-9

[https://doi.org/10.1016/j.ijhm.2020.102706]

-

Alavi, M., Visentin, D. C., Thapa, D. K., Hunt, G. E., Watson, R., and Cleary, M. L. (2020), Chi-square for model fit in confirmatory factor analysis.

[https://doi.org/10.1111/jan.14399]

-

Armstrong, A. (2020), Ethics and ESG, Business and Finance Journal, 14(3), 6-17.

[https://doi.org/10.14453/aabfj.v14i3.2]

-

Ashwin Kumar, N. C., Smith, C., Badis, L., Wang, N., Ambrosy, P., and Tavares, R. (2016), ESG factors and risk-adjusted performance, Journal of Sustainable Finance & Investment, 6(4), 292-300.

[https://doi.org/10.1080/20430795.2016.1234909]

-

Aydoğmuş, M., Gülay, G., and Ergun, K. (2022), Impact of ESG performance on firm value and profitability, Borsa Istanbul Review, 22(2). 1-9

[https://doi.org/10.1016/j.bir.2022.11.006]

-

Ayuso, S., Rodriguez, M. A., and Ricart, J. E. (2006), Responsible competitiveness at the “micro” level of the firm: Using stakeholder dialogue as a source for new ideas: A dynamic capability underlying sustainable innovation, Corporate Governance, 6(4), 475-490.

[https://doi.org/10.1108/14720700610689586]

-

Berg, F., Koelbel, J. F., and Rigobon, R. (2022), Aggregate confusion: The divergence of ESG ratings, Review of Finance, 26(6), 1315-1344.

[https://doi.org/10.1093/rof/rfac033]

-

Budsaratragoon, P. and Jitmaneeroj, B. (2021), Corporate Sustainability and Stock Value in Asian-Pacific Emerging Markets, Sustainability, 13(11), 1-9

[https://doi.org/10.3390/su13116458]

-

Byun, S. K. and Oh, J. M. (2018), Local corporate social responsibility, media coverage, and shareholder value, Journal of Banking & Finance, 87, 68-86.

[https://doi.org/10.1016/j.jbankfin.2017.09.010]

-

Cornell, B. and Shapiro, A. C. (2021), Corporate stakeholders, corporate valuation and ESG, European Financial Management, 27(2), 196-207.

[https://doi.org/10.1111/eufm.12299]

- Dahlberg, L. and Wiklund, F. (2018), ESG Investing In Nordic Countries.

-

Garcia, A. S., Mendes-Da-Silva, W., and Orsato, R. J. (2017), Sensitive industries produce better ESG performance: Evidence from emerging markets, Journal of Cleaner Production, 150, 135-147.

[https://doi.org/10.1016/j.jclepro.2017.02.180]

- Henisz, W., Koller, T., and Nuttall, R. (2019), Five ways that ESG creates value, McKinsey Quarterly.

-

Ismail, A. M., Adnan, Z. H. M., Fahmi, F. M., Darus, F., and Clark, C. (2019), Board capabilities and the mediating roles of absorptive capacity on environmental social and governance (ESG) practices, International Journal of Financial Research, 10(3), 11-30.

[https://doi.org/10.5430/ijfr.v10n3p11]

-

Jarvis, W., Ouschan, R., Burton, H. J., Soutar, G., and O’Brien, I. M. (2017), Customer engagement in CSR, Journal of Service Theory and Practice, 27(4), 833-853.

[https://doi.org/10.1108/JSTP-04-2016-0081]

-

Kim, S. and Li, Z. (2021), Understanding the impact of ESG practices in corporate finance, Sustainability, 13(7), 1-15.

[https://doi.org/10.3390/su13073746]

- Kline, R. B. (2015), Principles and practice of structural equation modeling, Guilford publications.

-

Li, N., Huang, J., and Feng, Y. (2020), Construction and confirmatory factor analysis of the core cognitive ability index system of ship C2 system operators, PloS one, 15(8), 1-23.

[https://doi.org/10.1371/journal.pone.0237339]

-

Li, T. T., Wang, K., Sueyoshi, T., and Wang, D. D. (2021), ESG: Research progress and future prospects, Sustainability, 13(21), 1-28.

[https://doi.org/10.3390/su132111663]

-

Liang, H. and Renneboog, L. (2020), Corporate social responsibility and sustainable finance: A review of the literature, European Corporate Governance Institute, 1-43.

[https://doi.org/10.2139/ssrn.3698631]

-

Litvinenko, V., Bowbrik, I., Naumov, I., and Zaitseva, Z. (2022), Global guidelines and requirements for professional competencies of natural resource extraction engineers: Implications for ESG principles and sustainable development goals, Journal of Cleaner Production, 1-9.

[https://doi.org/10.1016/j.jclepro.2022.130530]

-

MacNeil, I. and Esser, I. M. (2022), From a financial to an entity model of ESG, European Business Organization Law Review, 23(1), 9-45.

[https://doi.org/10.1007/s40804-021-00234-y]

-

Menner, M. and Menninger, F. (2018), The Causal Effect of Corporate Governance on Employee Satisfaction.

[https://doi.org/10.2139/ssrn.3249006]

-

Mardini, G. H. (2022), ESG factors and corporate financial performance, International Journal of Managerial and Financial Accounting, 14(3), 247-264.

[https://doi.org/10.1504/IJMFA.2022.123895]

-

Nilsson, J., Jansson, J., Isberg, S., and Nordvall, A. C. (2014), Customer satisfaction with socially responsible investing initiatives: The influence of perceived financial and non-financial quality, Journal of Financial Services Marketing, 19, 265-276.

[https://doi.org/10.1057/fsm.2014.24]

- Ondoro, C. O. (2015), Measuring Organization Performance: From Balanced Scorecard to Balanced ESG Framework, International Journal of Economics, Commerce and Management, 11(3), 1-11.

-

Pettersson, E. and Turkheimer, E. (2010), Item Selection, Evaluation, and Simple Structure in Personality Data, Journal of research in personality, 44(4), 407-420

[https://doi.org/10.1016/j.jrp.2010.03.002]

-

Piao, X., Xie, J., and Managi, S. (2022), Environmental, social, and corporate governance activities with employee psychological well-being improvement, BMC Public Health, 22(1), 1-12.

[https://doi.org/10.1186/s12889-021-12350-y]

- Refinitiv (2022, May), Environmental, Social and Governance Scores From Refinitiv, Retrieved March 9, 2023, from https://www.refinitiv.com/, .

-

Signori, S., San-Jose, L., Retolaza, J. L., and Rusconi, G. (2021), Stakeholder value creation: Comparing ESG and value added in European companies, Sustainability, 13(3), 1392.

[https://doi.org/10.3390/su13031392]

-

Sinaga, K. P. and Yang, M. S. (2020), Unsupervised K-means clustering algorithm, IEEE access, 8, 1-12.

[https://doi.org/10.1109/ACCESS.2020.2988796]

-

Singhania, M. and Saini, N. (2023), Institutional framework of ESG disclosures: Comparative analysis of developed and developing countries, Journal of Sustainable Finance & Investment, 13(1), 516-559.

[https://doi.org/10.1080/20430795.2021.1964810]

-

Stojanovic, A., Milosevic, I., Arsic, S., Urosevic, S., and Mihajlovic, I. (2020), Corporate social responsibility as a determinant of employee loyalty and business performance, Journal of Competitiveness, 12(2), 149.

[https://doi.org/10.7441/joc.2020.02.09]

-

Tan, Y. and Zhu, Z. (2022), The effect of ESG rating events on corporate green innovation in China, Technology in Society, 68(1), 1-13.

[https://doi.org/10.1016/j.techsoc.2022.101906]

-

Tarmuji, I., Maelah, R., and Tarmuji, N. H. (2016), The impact of environmental, social and governance practices (ESG) on economic performance, International Journal of Trade, Economics and Finance, 7(3), 67-74.

[https://doi.org/10.18178/ijtef.2016.7.3.501]

- The World Bank (2022, December 12), Sovereign ESG Data Framework. Sovereign ESG Data Portal, Retrieved March 9, 2023, from https://esgdata.worldbank.org/data/framework, .

- United Nations (2004), Who Cares Wins: Connecting the Financial Markets to a Changing World? United Nations, Retrieved March 9, 2023, from https://www.unglobalcompact.org/docs/issues_doc/Financial_markets/who_cares_who_wins.pdf, .

-

Van Duuren, E., Plantinga, A., and Scholtens, B. (2016), ESG integration and the investment management process: Fundamental investing reinvented, Journal of Business Ethics, 138, 525-533.

[https://doi.org/10.1007/s10551-015-2610-8]

-

Vellone, E., Jaarsma, T., Stromberg, A., Fida, R., Arestedt, K., Rocco, G., ... and Alvaro, R. (2014), The European Heart Failure Self-care Behaviour Scale, Patient Education and Counseling, 94(1), 97-102.

[https://doi.org/10.1016/j.pec.2013.09.014]

-

Wu, A. D., Zumbo, B. D., and Marshall, S. K. (2014), A method to aid in the interpretation of EFA results, International Journal of Behavioral Development, 38(1), 98-110.

[https://doi.org/10.1177/0165025413506143]

-

Xia, Y. and Yang, Y. (2019), RMSEA, CFI, and TLI in structural equation modeling with ordered categorical data: The story they tell depends on the estimation methods, Behavior research methods, 51, 409-428.

[https://doi.org/10.3758/s13428-018-1055-2]

-

Yang-Wallentin, F., Jöreskog, K. G., and Luo, H. (2010), Confirmatory Factor Analysis of Ordinal Variables With Misspecified Models, Structural Equation Modeling, 17(3), 392-423.

[https://doi.org/10.1080/10705511.2010.489003]

-

Zumente, I. and Bistrova, J. (2021), ESG importance for long-term shareholder value creation: Literature vs. practice, Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 1-13.

[https://doi.org/10.3390/joitmc7020127]

Appendix

저자소개조영주 : 네브라스카 주립대에서 경영학사와 데이터 분석 석사 과정 졸업 후, 연세대학교 산업공학 박사과정에 재학 중이다. 주요 관심분야는 기술경영, 조직관리이다.

박준성 : 연세대학교 산업공학과를 졸업하고, 동대학원에서 박사과정에 재학 중이다. 주요 관심분야는 소비자 행동, 플랫폼 이론 등이다.

유준우 : 연세대학교 산업공학과를 졸업하고, 동대학원에서 박사과정에 재학 중이다. 주요 관심분야는 기술경영, 경영관리이다.

이창근 : 육군사관학교 경영학과를 졸업하고, 연세대학교 일반대학원 산업공학과에서 석사과정에 재학 중이다. 주요 관심분야는 기술경영, 품질경영이다.

박희준 : George Washington University에서 공학경영 전공으로 박사학위를 취득하고 Marymount University 경영학과에 재직하였으며, 현재 연세대학교 산업공학과에 재직 중이다. 주요 관심 분야는 플랫폼 기반의 혁신 전략, 비즈니스 모델 개발, 전략 수립 및 성과평가 방법론 개발 등이다.